The US Government is broke, and will default on its obligations. The likelihood of default is 100% guaranteed according to economist Gary North.

National debt is the tip of the iceberg

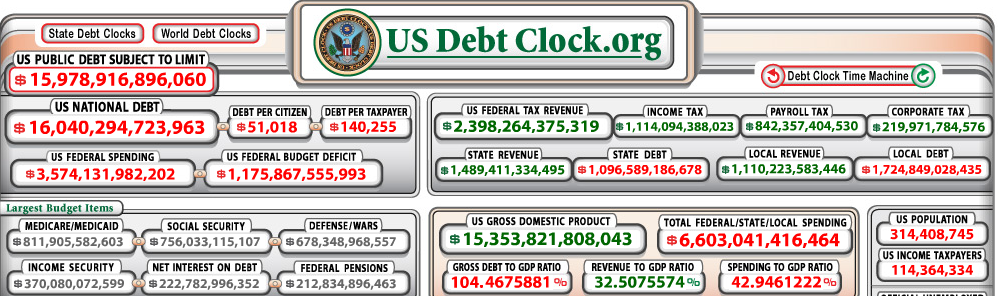

Most people are at least superficially aware the US government has a large debt level, which at the time of this article is $16 Trillion. Put in other terms, this is 104% of the entire country’s annual GDP, and $140K owed per taxpayer.

Put yet another way – – Let’s say the government confiscated every penny, nickel, dollar from the sale of every single good and service produced by the American people for one year and applied it to the national debt. Not only would the people not have any money to house, feed, clothe…etc themselves, but there would still be a residual $640 billion debt owed.

When confronted with a debt problem, a typical household would consume/spend less than they produced/took in income, and use the saved amount as payment towards reducing the debt. For the government, it would take a massive decrease in the size and scope of government to even begin paying down a minor percentage of the national debt.

Judging by the general reaction to Ron Paul’s proposal to cut $1 Trillion in the first year, there does not appear to be an appetite for any serious cut to government spending anytime soon.

It’s the entitlements, stupid!

While most folks are partially aware of the debt problem, they are almost completely unaware of the much larger problem with the US government’s unfunded liabilities. Depending on the sources being referenced, this number is somewhere between $120 Trillion and $222 Trillion.

Unfunded liabilities are the promises made by current or prior generations with the expectation these liabilities would be paid for by taxing future generations (i.e. our kids and grandkids). The “unfunded” part comes because there is currently no assigned or known revenue (tax) source by which to pay for them.

These promises/liabilities are primarily in Medicare, Social Security, Medicaid, and Federal Pensions. Medicare in particular continues to pay benefits out appromiately $2 for every $1 that the beneficiary pays into the program. With the unlimited benefits, no questions asked administration, and 200% average return on what they paid in, is it any wonder Medicare is so popular with its users? With baby boomers coming to retirement age, and a decreasing or stagnant childbirth rate, we begin to see the genesis and magnitude of these future debts.

Can we reform these entitlements?

A lot of time and energy is spent debating what type of reforms should be considered to keep these entitlement programs solvent. Tax increases? Raising the minimum age requirements? Benefit cuts?

Of particular interest to the two major political parties is the idea of means testing the benefit levels. Essentially, they want to assess your “need” before determining the level of benefits to which you will be eligible. If you are wealthy, then your need is zero, and thus your benefits may also be zero – – regardless of the fact that you paid into the program your entire working life.

These programs were initially touted as “insurance” in order to gain the acceptance of the general public and the Supreme Court. Later, the government changed the program rules and intent to an “entitlement”. Now, it appears ever more likely they will be changed yet again to the what their originators envisioned in the first place – – wealth redistribution programs. “From each according to his ability; to each according to his needs.”

In the end, no progress or serious reforms will be made until external forces and popular opinion force some level of action. Until then, both sides howl with indignation at the supposed inhumanity of the other side’s proposals, but two basic facts remain the same

- Both the Republican and Democrat parties preach the desireability of these entitlement programs; programs with principles aligned to the core of socialism/marxism.

- None of the proposed reforms will be significant enough to fix the upcoming insolvency and unfunded liability gap.

What about printing the money?

We’ve already taken a look at the difficulty associated with the normal approach to debt payment. This will be extremely difficult for the $16T national debt, and clearly impossible for the $222T in unfunded liabilities.

Likewise, program reforms will provide only a temporary and small reprieve against the massive unfunded liability problem.

There is however, another option being discussed publicly more often – – inflation. Alan Greenspan and others believe we would never have to default because the US can simply print the dollars it requires. Let’s forget for a second that debasing/inflating the monetary unit is truly the same as default, just gauged by a matter of magnitude. Let’s also forget that debasing/inflating our money is immoral theft of each individuals purchasing power, and just an less obvious form of taxation. Let’s forget these things and ask — could printing money work?

Going back to Gary’s article

The expansion of the monetary base can go on until such time as commercial banks monetize all of the reserves on their books. Prices then rise to such levels that transactions no longer take place in the official currency unit. The division of labor contracts. The output of capital and labor falls. At some point, people adopt other currency units. They no longer cooperate with each other by means of the hyperinflated currency.

Professor Steve Hanke has co-authored an article on the worst 56 hypernflations. He discovered that most of these in industrial nations were over in a couple of years. The crack-up boom ended them.

No nation can long pursue a policy of hyperinflation. It destroys the currency and destroys the division of labor. The result is starvation. The policy of hyperinflation ends before this phase. Members of society shift to other forms of money.

This is why the policy of hyperinflation is useless in dealing with the 75-year obligations of the federal government to support old people through Social Security, Medicare, Medicaid, and federal pensions. These obligations are inter-generational. Hyperinflation lasts for months, not decades. When the government ends its policy of hyperinflation, it finds that it is still saddled with these obligations.

If the Federal Reserve resorts to hyperinflation, its retirement portfolio will reach zero value unless it shifts to foreign currencies, gold, or other hyperinflation hedges. It will publicly announce that the U.S. dollar is a failed currency, as manipulated by the FED.

If it refuses, then it will oversee Great Depression 2, monetary deflation, and the contraction of the division of labor. The U.S. government will go bankrupt.

If Congress nationalizes the FED, then it will pursue hyperinflation. The crack-up boom will end the experiment.

At that point, all of the obligations to retirees will still remain. But the government will not have the money to pay them. The $222 trillion of present valued unfunded liabilities will still remain unfunded.

The government’s obligations are inter-generational. Hyperinflation is not. The latter in no fundamental way reduces the former.

This means that the government will default. This is 100% guaranteed.

We would need to print almost unimaginable amounts within a very short amount of time (aka Hyperinflation). These steps would very quickly cause the US dollar to lose its precious status as the world’s reserve currency, and the entire fiat house of cards would crash down within a matter of weeks, months, or years. But as noted above, this does not solve the problem because these obligations continue for decades.

Thanks to bipartisan and popular support for socialist programs – – there is no doubt that the US government will default on its obligations. The only remaining question is the type/level of pain we experience before we get to that point.

I started wonkrig for the state of Illinois at the age of 37, I spent $38,000 of my own money buying back my military service credits so I could retire at the age of 55 with 20 yrs of service for the taxpayers of Illinois protecting them from the criminals of this state. Now I was told on 3-28-11 that the state lawmakers have told our union today that they want to eliminate our pensions completely. If this is done I feel the state should pay me what I could have made by investing this $38,000 plus my monthly contributions to my pension which is $588.00 per month for the last 16 yrs. If I had known at the last minute these worthless lawmakers would be willing to become turncoats I never would have accepted employment with this state. let alone allow them to waste my life and money!!!

Shannon, I believe it prabboly saved more jobs than it created, but it did do both. Enough to keep the unemployment rate low? No. Look, I’ve read the CBO report about the jobs that were indeed created through the American Recovery and Re-Investment Act. I’ve talked to people in my own county that told me how stimulus money here went to projects that required hiring people. I’ve read other news stories about stimulus-funded projects. Now, do you have some examples of companies out there that had to fire massive amounts of people because the government injected hundreds of millions of dollars into the economy? Because I’d really be interested in reading them, provided they are from a legitimate source, not some sketchy article that takes me on a journey through links to even more sketchy articles. Arriba is saying that Pelosi has pushed through nothing but job KILLING legislation. I want proof that one of the most major pieces of legislation she pushed through actually killed jobs.